NAMIC and its industry partners often collaborate or jointly publish expert research and analysis to provide NAMIC members with the knowledge needed to successfully navigate the ever-changing property/casualty insurance landscape.

Small Mutual Insurance Companies: Challenges, Solutions, And Opportunities

Small mutual insurance companies have a rich history in the United States, deeply rooted in the agricultural and rural communities…

Scenario Testing Our Mutual Future – Year Three

For the third consecutive year, NAMIC has partnered with Guy Carpenter to model the impact of risk scenarios on the…

Scenario Testing Our Mutual Future – Year Two

As industries around the globe face growing political, economic, and environmental challenges, the mutual property/casualty insurance industry remains a strong…

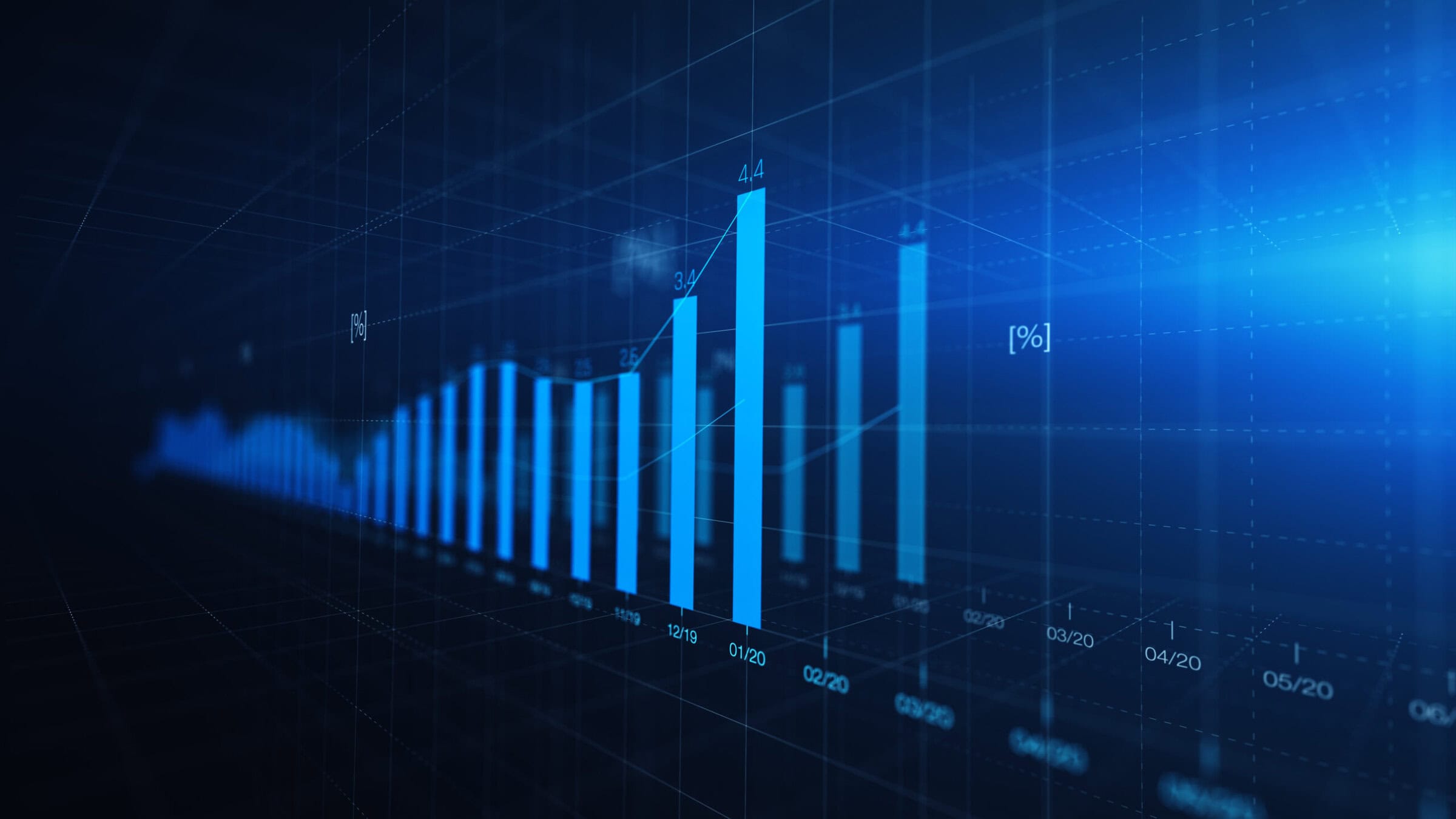

The Current Inflationary Spiral: What’s Driving It?

As we moved through 2022, it became increasingly clear the inflationary pressures seen in 2020 and 2021 had settled in…

Scenario Testing Our Mutual Future

In a world forever changed by the COVID–19 pandemic, mutual property/casualty insurance companies of all sizes are facing increasing pressure…