It is no secret that the property/casualty insurance industry continues to face myriad challenges in the new era of risk. Yet, the 2025 Mutual Factor proves that mutual insurers remain committed to the industry’s mission and to maintain sound financial status so they can deliver for their policyholders.

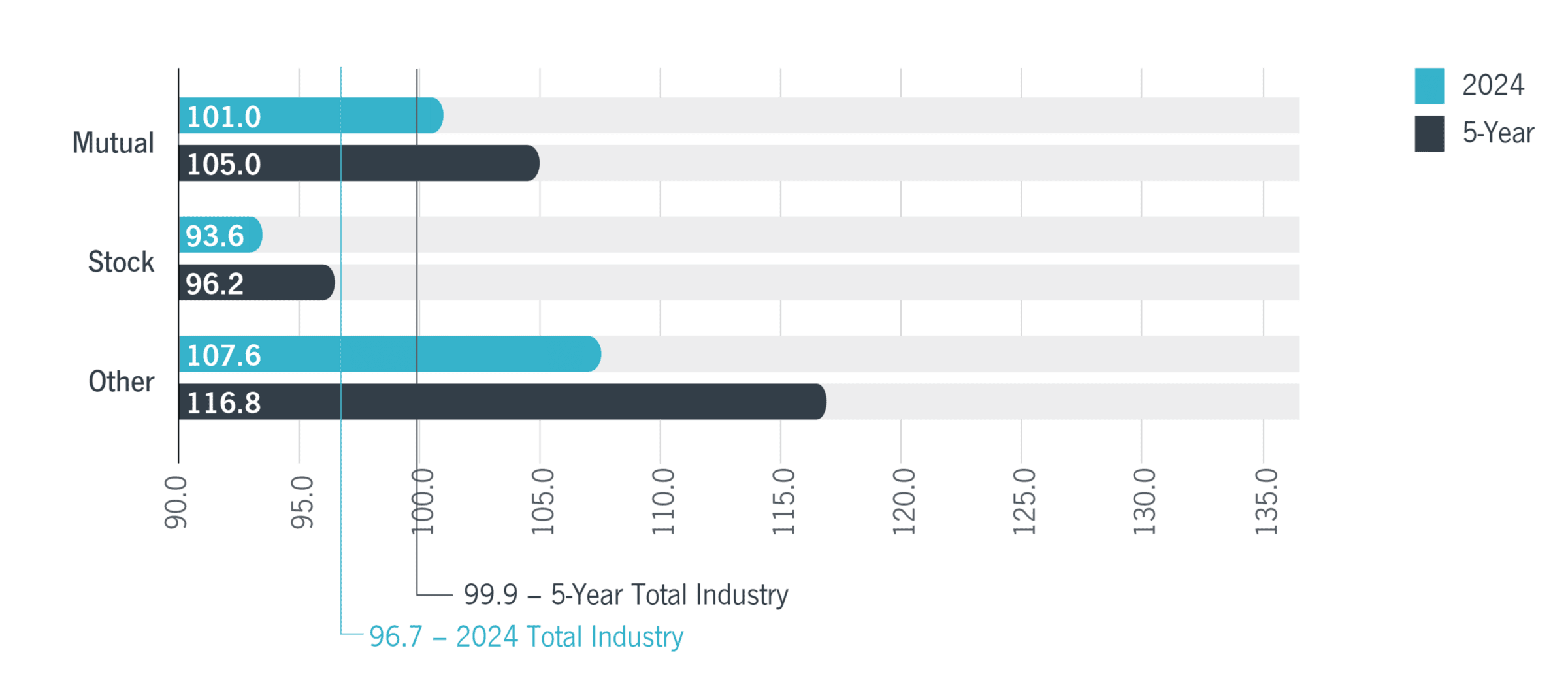

In fact, this year’s report will show that mutuals have begun to close the combined ratio gap between them and their stock company counterparts.

2024 Highlights – Mutual Segment Sees Continued Improvement

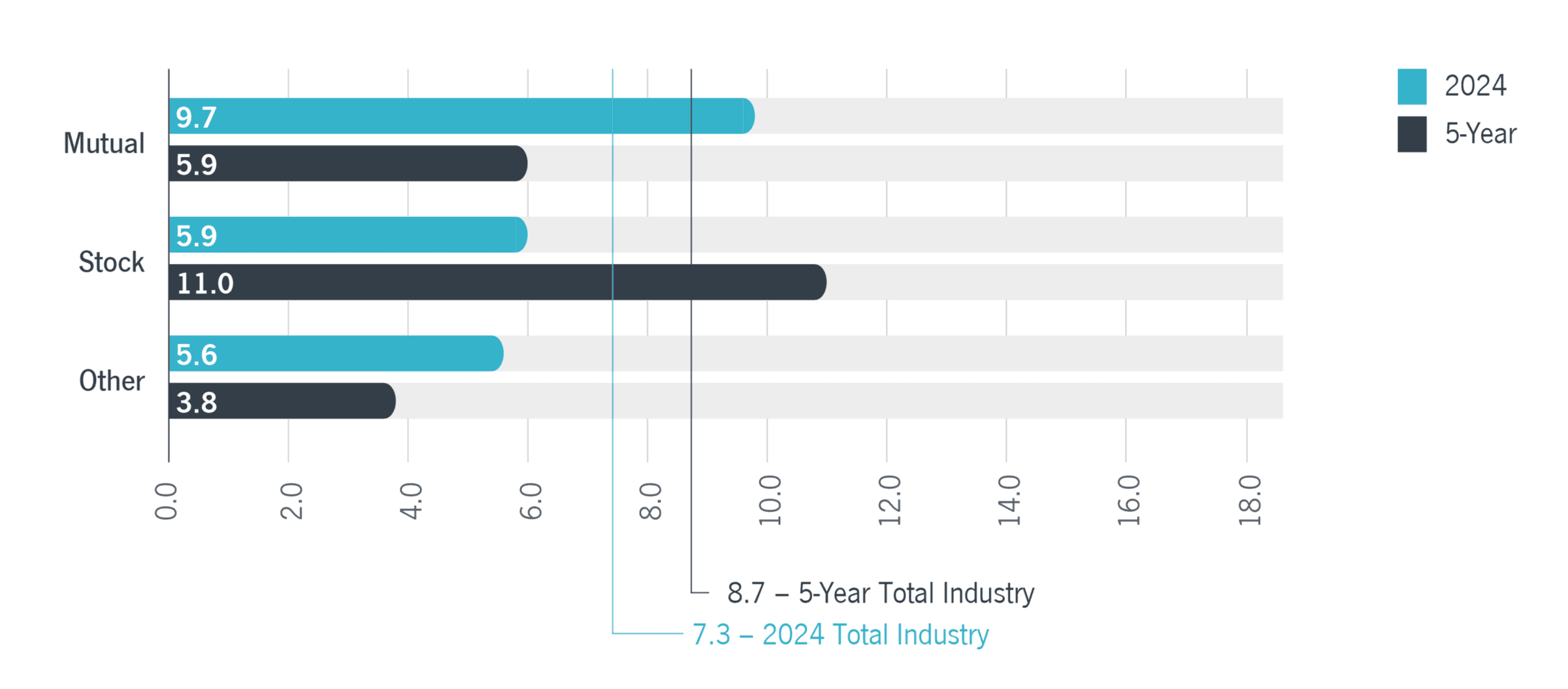

Capital and Surplus Growth

- Surplus for the entire property/casualty industry grew by 7.3%, which is more than one point higher than the surplus growth in 2023;

- The mutual segment’s growth was nearly four points higher than the stock segment’s growth.

Combined Ratio

- Mutual insurers experienced a nine-point improvement in their combined ratios;

- Mutuals’ 2024 combined ratio equaled 101.0 while their five-year average equaled 105.0;

- 86% of mutual companies have an AM Best rating of “A-” or higher, and 84% have a “Positive” or “Stable” outlook;

- 88% of mutual companies have “Strongest” or “Very Strong” balance sheet strength, compared to 80% of stock companies.

Insurance Buyer Survey Highlights – Mutuals Gain Strength in Policyholder Perceptions

NAMIC worked with Readex Research this summer to survey commercial insurance buyers about their purchasing preferences and familiarity with the mutual property/casualty insurance industry. The association conducted a similar survey in 2019. The 2025 survey found that commercial insurance buyers are more familiar with and have a more positive perception of mutuals now than they did six years ago.

- Commercial insurance buyers’ familiarity with and favorability of mutual insurers rose 13 points and 17 points, respectively, since the previous survey;

- Survey respondents associated mutual insurers with financial strength, affordable prices, and excellent customer service;

- Approximately 75 percent of respondents have a favorable impression of the commercial insurance industry in general, which is an 11-point increase since 2019.

Related Resources

IN Magazine – Winter 2025

You’ve reached members-only content. If your company is a NAMIC member and you’re a NAMIC.org registered user, please make sure…

IN Magazine – Fall 2025

You’ve reached members-only content. If your company is a NAMIC member and you’re a NAMIC.org registered user, please make sure…

IN Magazine – Summer 2025

You’ve reached members-only content. If your company is a NAMIC member and you’re a NAMIC.org registered user, please make sure…